2025 Honda Civic Insurance Cost: A Comprehensive Guide

By admin / May 25, 2024 / No Comments / 2025

2025 Honda Civic Insurance Cost: A Comprehensive Guide

The 2025 Honda Civic, a beloved compact car known for its reliability, efficiency, and stylish design, is likely to be a popular choice for drivers of all ages. However, before you hit the road in your shiny new Civic, it’s crucial to understand the associated insurance costs. This comprehensive guide will explore the factors that influence 2025 Honda Civic insurance premiums, provide an estimated cost range, and offer tips to save on your policy.

Factors Influencing 2025 Honda Civic Insurance Costs

Several factors, both related to the vehicle and the policyholder, determine the cost of insuring a 2025 Honda Civic. Understanding these factors can help you anticipate your potential premiums and make informed choices to minimize them.

1. Vehicle-Related Factors:

- Vehicle Model and Trim: The 2025 Civic will likely be available in various trims, each with its own features and safety technology. Higher trims with advanced safety features, such as adaptive cruise control and lane departure warning, may qualify for discounts and result in lower insurance premiums.

- Safety Ratings: The 2025 Civic is expected to receive high safety ratings from organizations like the IIHS and NHTSA. These ratings reflect the vehicle’s safety performance and can significantly impact insurance costs. Vehicles with excellent safety ratings are often considered less risky to insure, leading to lower premiums.

- Theft Risk: The Civic’s popularity and desirability can make it a target for theft. Areas with high theft rates may see higher insurance premiums for the 2025 Civic.

- Repair Costs: The cost of repairing a 2025 Civic after an accident will be a factor in insurance premiums. Vehicles with expensive parts or complex repairs may lead to higher insurance costs.

- Vehicle Value: The 2025 Civic’s value will influence the cost of comprehensive and collision coverage. As the vehicle depreciates over time, the cost of these coverages will decrease.

2. Policyholder-Related Factors:

- Driving History: Your driving record, including accidents, violations, and claims history, significantly impacts insurance premiums. A clean driving record generally leads to lower rates.

- Age and Gender: Younger drivers, particularly males, are statistically more likely to be involved in accidents. This can result in higher insurance premiums.

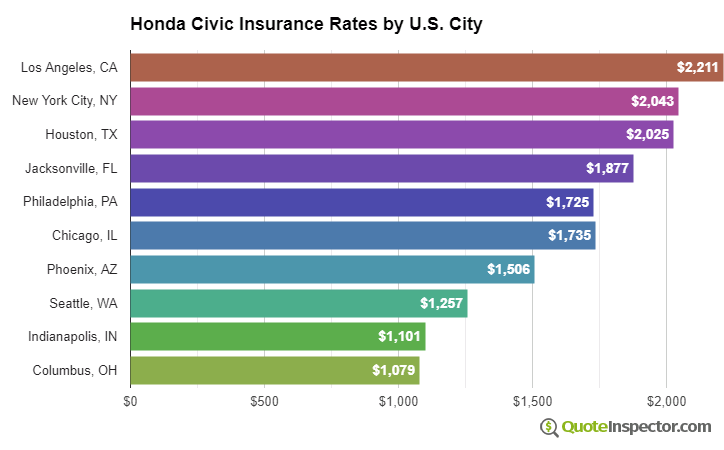

- Location: Factors like population density, crime rates, and traffic congestion in your area can influence insurance costs. Urban areas with high traffic volume and accident rates often have higher premiums.

- Credit Score: In some states, insurance companies use credit score as a factor in determining premiums. A good credit score may lead to lower rates.

- Driving Habits: Factors like mileage, driving purpose (commute, leisure), and time of day you drive can affect your insurance premiums.

- Coverage Choices: The type and amount of coverage you choose will influence your premiums. Higher coverage limits generally result in higher costs.

Estimated 2025 Honda Civic Insurance Cost Range

Predicting the exact insurance cost for a 2025 Honda Civic is impossible without specific details about the policyholder and their driving history. However, based on historical data and industry trends, here’s an estimated cost range:

- Minimum Liability Coverage: $500 – $1,000 per year

- Full Coverage (Comprehensive & Collision): $1,500 – $3,000 per year

This is just a rough estimate, and actual costs can vary widely depending on the factors mentioned above.

Tips to Save on 2025 Honda Civic Insurance

While you can’t control all factors influencing insurance costs, you can take steps to reduce your premiums:

- Shop Around: Compare quotes from multiple insurers to find the best rates.

- Bundle Your Policies: Combining your auto insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Maintain a Clean Driving Record: Avoid accidents and violations to keep your premiums low.

- Consider a Higher Deductible: Opting for a higher deductible can lower your monthly premiums, but be sure you can afford to pay the deductible in case of an accident.

- Take a Defensive Driving Course: Completing a defensive driving course can earn you discounts and improve your driving skills.

- Ask About Discounts: Inquire about available discounts, such as good student, safe driver, multi-car, or loyalty discounts.

- Maintain a Good Credit Score: If your state uses credit score for insurance pricing, maintaining a good credit score can save you money.

- Choose the Right Coverage: Select the coverage that meets your needs and budget. Avoid unnecessary extras that can increase your premiums.

Conclusion

Insuring your 2025 Honda Civic is an essential step in owning and operating this reliable and stylish vehicle. Understanding the factors influencing insurance costs and taking steps to save on your premiums can help you budget effectively and ensure you’re protected on the road. Remember to shop around, compare quotes, and choose the coverage that best suits your individual needs and financial situation. By being informed and proactive, you can secure affordable insurance for your 2025 Honda Civic and enjoy the peace of mind that comes with it.

![Best Honda Civic Insurance Cost In 2022: [Expert Advice]](https://www.mountshine.com/wp-content/uploads/2022/10/Honda-Civic-Insurance-1536x864.jpg)